ABC of Accounting – Accounting Ratios – Part 1

Accounting ratios are a very useful tool to use when analysing the performance of your business. Knowing how to use and interpret these will enable you to get a better understanding of your business and in turn act as an aid to manage your business and ultimately help it grow.

Is your business Profitable

It’s all about making a profit and many business owners out there still get confused with gross and net profit and there’s a big difference. You need to be able to make a gross profit in order to have enough left to not only cover your overheads and fixed expenses but to plough into your next years projections especially if you’re looking to expand.

Gross Profit

Your gross profit is calculated by subtracting the cost of your goods sold from your revenue/sales and your gross profit margin as a percentage is calculated by using the formula Total Revenue – Cost of Goods Sold / Total Revenue x 100.

For example, if a company has a total revenue for the month of £150k and cost of sales/goods of £82.5k the calculation would be :

Gross margin = (total revenue/sales = £150K – Cost of sales/goods = £82.5k) / total revenue £150k x 100 = Gross profit 45.%

Your gross profit may vary from month to month depending on your type of sales, you may achieve a greater profit margin on certain sales or services that you can only sell at a certain time of year especially if your business is seasonal and you may reflect this in the price your charge to your customer.

Net profit

Net profit is based on the amount of profit remaining after the deduction of all overheads, expenses and fixed costs have been calculated and then deducted from the gross profit.

For example, based on the gross profit of the above of Revenue of £150k less the cost of sales/goods sold of £82.5k gives you a gross profit of £67.5k

If your overheads and fixed costs are then totalled and come in at £35k to calculate your net profit you would take:

Revenue £150K – (cost of sales £82.5K + overheads etc £35K = £117.5K) = £32.5 net profit, and to express this as a percentage the calculation would be £32.5K /£150K x 100 giving you a net profit of 21.6%

As the net profit is calculated after taking all costs into consideration you may want to look at these in detail, ensuring that nothing has been missed such as depreciation. This maybe a cost you account for at your year end however, it may be prudent to include a monthly accrual for items which you know you will be charged for at a later date as this will prevent extreme fluctuations in your net profit.

Liquidity ratios

The liquidity or solvency ratio will determine if a business has enough funds/working capital to pay its suppliers/creditors. If not then it will become insolvent. In short a business that owns more than it owes is solvent. A business will need both solvency and liquidity to perform well.

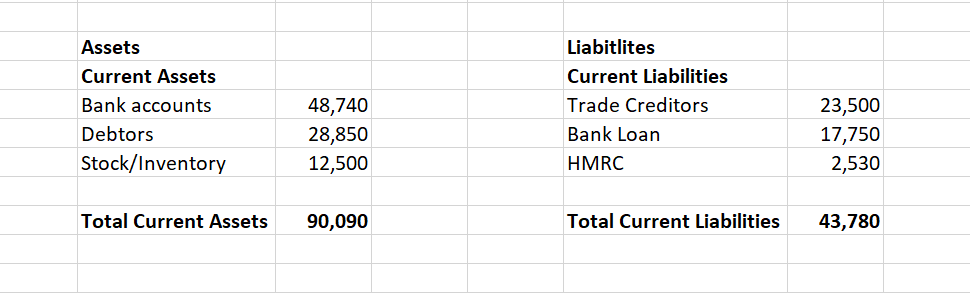

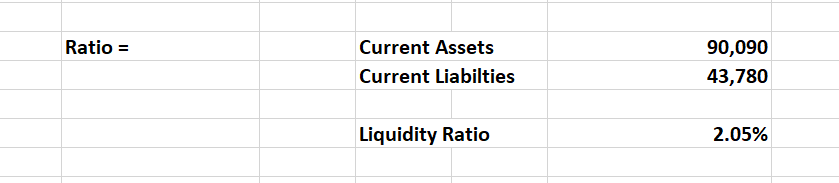

To calculate the liquidity ratio you will need the balance sheet and divide the current assets by the current liabilities, for example:

The ideal ratio would be at least 2 to 1 showing that for every £1 a company owes it has £2 in current assets, the higher the ratio the stronger the company is perceived to be.

Comments

Post a Comment